Stock in Focus: Telix Pharmaceutical (TLX)

Who are they and what do they do?

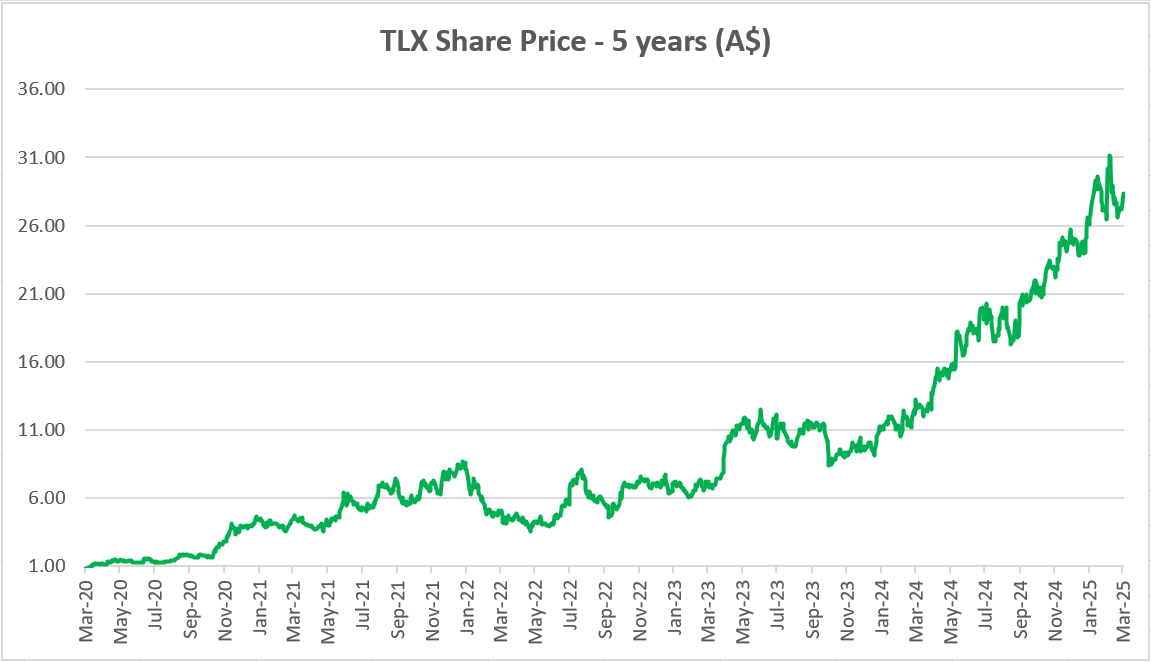

Telix Pharmaceutical (TLX) is a healthcare company focused on the development and commercialisation of various radiopharmaceutical assets. Telix has one already-commercial asset, Illuccix, which has hundreds of millions of dollars in annual sales and underwrites the company’s future growth. As part of Lennox’s process, we do not invest in businesses that are yet to receive full approval for new drugs or therapies as their path to commercialisation (and therefore the business’s success/failure) can be dependant on the outcome of a binary approval. Telix is a great example of a company that has advanced through the full approval and commercialisation process with its flagship drug Illucix and investors are now reaping the rewards.

What are our 3 key drivers for the company?

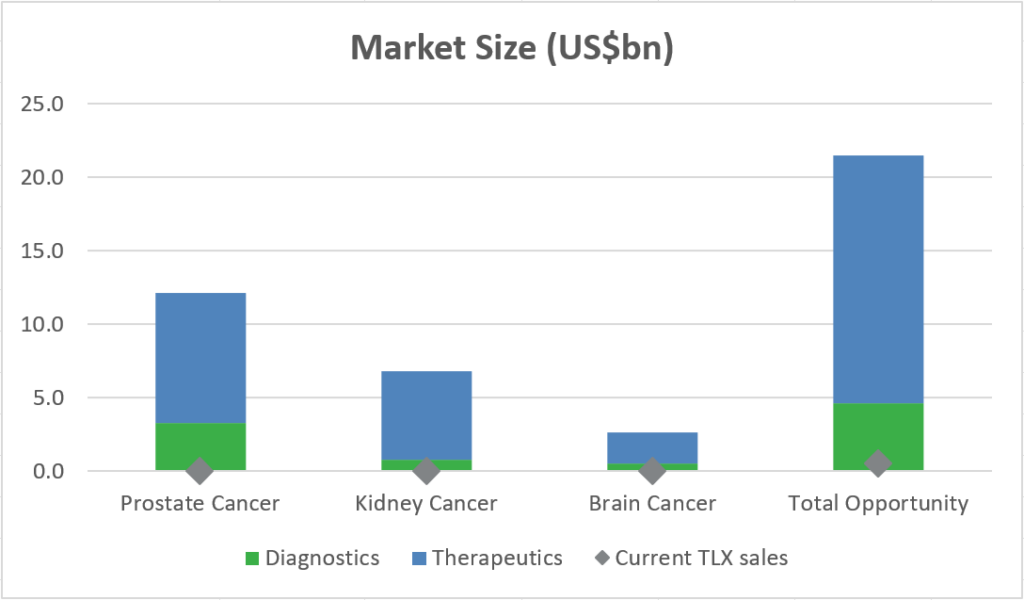

- Expansion of prostate cancer diagnostic market: The addressable market for prostate cancer radiopharmaceutical diagnostics continues to surprise to the upside as the benefit over incumbent solutions continues to drive increased adoption. International expansion will also provide a further avenue of growth for TLX to drive market expansion.

- Prostate cancer diagnostics share gains: Illuccix has a supply chain advantage over its larger competitor product, Pylarify, which is a major differentiator in radiopharmaceuticals industry given radioactive products rapidly decay. We believe this should see Illuccix continue to take share in the prostate cancer diagnostic industry.

- Near-term pipeline delivery: The Illuccix asset underwrites TLX’s ability to continue investing in new assets. Several of these, including renal cancer diagnostic Zircaix, will begin to deliver revenues in the near-term. Others, such as TLX591, are therapeutic drugs in development which have a materially higher payoffs than diagnostics if successful.

What do we think the company is worth?

Lennox’s valuation is typically based on a combination of our year-3 earnings forecast for the company, coupled with the PE premium/discount we believe the business should trade on. On that basis we believe TLX could be worth well into the $40’s if estimates prove correct over coming years.

*Current Price as at 28 Mar 2025: $27.69 AUD

This material has been prepared by Lennox Capital Partners Pty Ltd ABN 19617001966 AFSL 498737 (Lennox). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon.

Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.