Stock in Focus: Integral Diagnostics (IDX)

Who are they and what do they do?

Integral Diagnostics (IDX) is a healthcare company focused on diagnostic imaging (DI). This includes traditional forms of DI like X-ray and ultrasound, but increasingly in new DI modalities like computed tomography (CT), magnetic resonance imaging (MRI) and nuclear medicine. IDX is one of the top 5 players nationally with ~150 sites across Australia and New Zealand.

What are our 3 key drivers for the company?

- Structural growth in DI: IDX has grown revenue at ~15% pa over the past 5 years and we believe they can do almost double that over the next 3 years. The recent merger with Capitol Health (CAJ) will definitely help this, but there is a clear structural tailwind. Volume growth is underwritten by underlying population growth as well as the ageing of that population driving higher demand on DI. Price growth is driven by funding indexation from Medicare and a shift in the mix from older/cheaper modalities like x-ray to newer/higher priced modalities including MRI and CT. The tailwind is real.

- Merger benefits from Capital Health (CAJ) integration: IDX and CAJ were previously the number 4 and 5 players respectively, while the combined entity will now be number 3. This scale should provide operating leverage from IDX’s new, larger footprint but also some sensible cost efficiencies that will drive margins higher. We believe this scale and efficiency benefit should see IDX able to grow earnings well in advance of revenue growth.

- Market share growth: Diagnostic Imaging is a ~$5bn p.a. industry in Australia. The current market share of IDX post-CAJ merger is only 14%. There is an opportunity for IDX to take share through expansion in NSW where they have virtually no presence.

What do we think the company is worth?

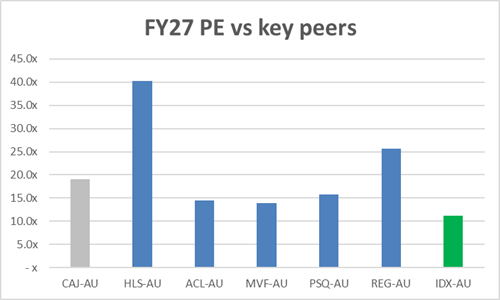

Lennox’s valuation is typically based on a combination of our year-3 earnings forecast for the company, coupled with the PE premium/discount we believe the business should trade on. On that basis we believe IDX could be worth $5+ on an FY27-basis. The opposite chart shows IDX’s relatively cheap year-3 PE versus key peers, including CAJ’s valuation as it merges into IDX.

This material has been prepared by Lennox Capital Partners Pty Ltd ABN 19617001966 AFSL 498737 (Lennox). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon.

Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.